Section 179 of the Tax Cuts and Jobs Act has been on the books since 2018 and many business owners are unaware that the incentive exists. The provision offers a deduction that has a real impact on commercial HVAC equipment costs. The new law can be a huge tax break for building owners and commercial tenants who invest in new commercial HVAC equipment.

Tax Cuts and Jobs Act

Section 179 of the Tax Cuts and Jobs Act is a financial incentive to encourage businesses to purchase equipment and invest in themselves. For the first time, the provision allows small business owners to take deductions for all commercial HVAC equipment purchases immediately. The commercial HVAC equipment only qualifies if it is purchased and put into use in the year in which the deduction is claimed.

Section 179 of the Tax Cuts and Jobs Act is a financial incentive to encourage businesses to purchase equipment and invest in themselves. For the first time, the provision allows small business owners to take deductions for all commercial HVAC equipment purchases immediately. The commercial HVAC equipment only qualifies if it is purchased and put into use in the year in which the deduction is claimed.

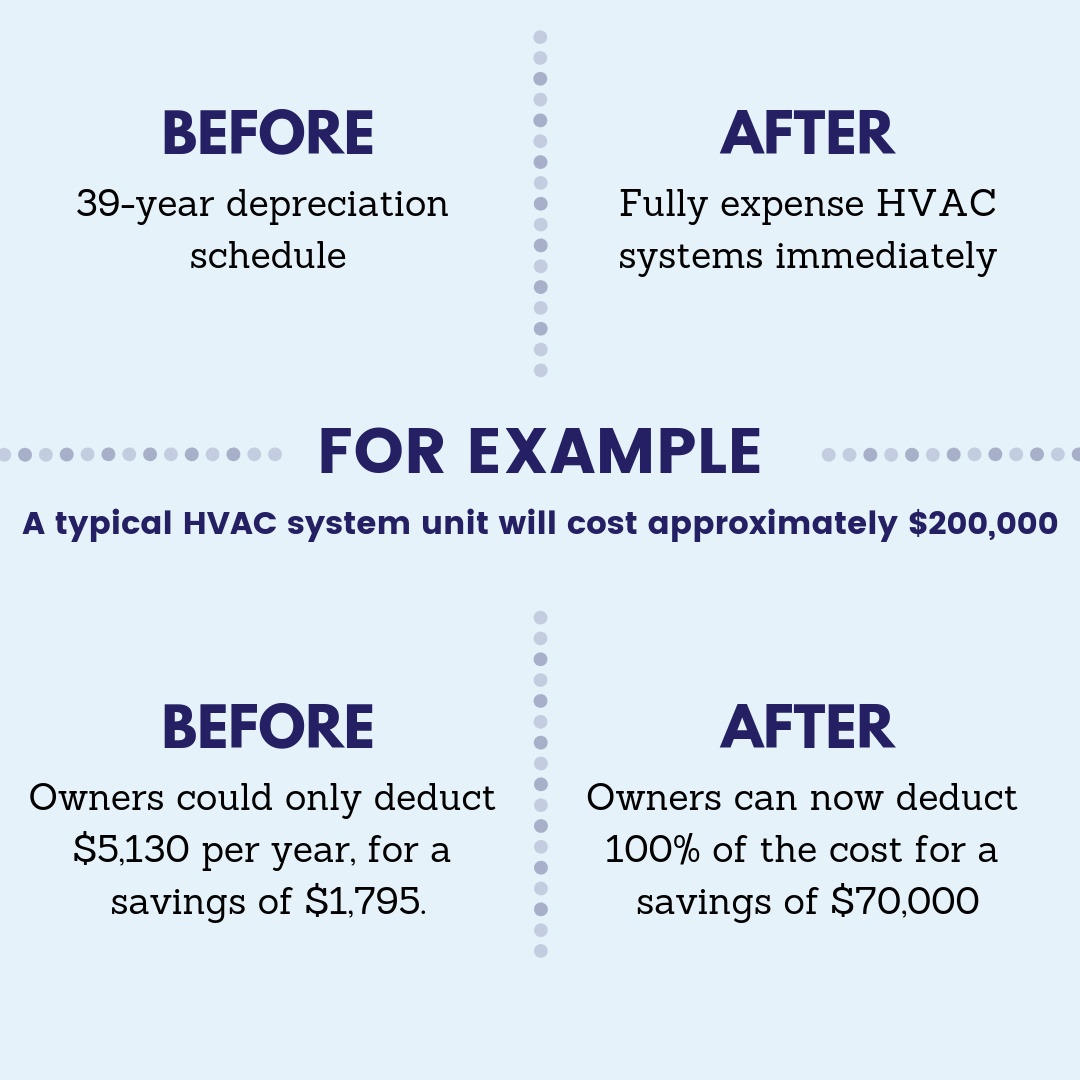

Before the change, commercial HVAC equipment was not considered as a capital improvement and was excluded from the Section 179 deduction. As a result, building owners and operators could deduct the full cost of their commercial HVAC systems over a period of 39 years through depreciation and was not considered for any tax breaks. Now, business owners can elect to deduct the full cost the year of their purchase.

Tax breaks on commercial HVAC equipment can be a great advantage for businesses taking the Section 179 deduction. The new deduction offers businesses a major tax break with tax savings and an opportunity to maximize purchasing power.

Advantages of Commercial HVAC Equipment Investment under Section 179

Section 179 provides contractors, clients, business owners, and building management decision-makers with tax code information relating to immediate tax breaks for commercial HVAC equipment. Making commercial HVAC improvements are now a win-win situation with several advantages. Section 179 deduction can add up to huge savings for a business owner.

Upfront Savings

One of the main advantages of the Section 179 deduction is upfront savings on your commercial HVAC equipment. The change from depreciation to immediate expensing of commercial HVAC equipment provides an exceptional tax-saving opportunity for contractors and business owners. Essentially, Section 179 allows you to immediately deduct the entire cost of the commercial HVAC equipment purchased or financed during the tax year as a business expense, therefore, if you buy or even lease a commercial HVAC component, you can deduct the entire cost from your gross income the same year. Using Section 179 to deduct your commercial HVAC purchases can significantly lower taxes in the year equipment is purchased.

One of the main advantages of the Section 179 deduction is upfront savings on your commercial HVAC equipment. The change from depreciation to immediate expensing of commercial HVAC equipment provides an exceptional tax-saving opportunity for contractors and business owners. Essentially, Section 179 allows you to immediately deduct the entire cost of the commercial HVAC equipment purchased or financed during the tax year as a business expense, therefore, if you buy or even lease a commercial HVAC component, you can deduct the entire cost from your gross income the same year. Using Section 179 to deduct your commercial HVAC purchases can significantly lower taxes in the year equipment is purchased.

For example, assume a business owner installs a new heating and air conditioning rooftop unit. The equipment and labor for installation cost $200,000. Before the Section 179 change, depreciation rules applied, and the owner could only deduct around $5,130 per year. At a 35 percent tax rate, that owner would only save around $1,795. After the Section 179 change, that owner may now save $70,000 in taxes immediately on that same $200,000 purchase.

Maximize Equipment Purchasing Power

It benefits you to take advantage of Section 179 deductions while they are available because the provision can offer you the opportunity to maximize purchasing power. The new provision makes a big difference to your business by allowing you to immediately deduct (with a deduction limit of $1 million) the full cost of your new or used commercial HVAC equipment (up to $2.5 million) as a business expense for the current tax year. Not only does this give you the ability to purchase needed equipment right away, instead of putting it off, but the amount you pay for the equipment is reduced substantially.

These tax cuts make it possible for commercial business owners to replace their old HVAC systems with new and more efficient equipment. The ability to purchase equipment when needed will lead to major tax breaks for building owners and commercial tenants who invest in new commercial HVAC equipment.

Money and Energy Savings

Not only will building owners and tenants receive tax benefits from updating commercial HVAC equipment but with the influx in technology in HVAC equipment, building owners can save a lot of money through the installation of a more energy efficient HVAC system resulting in lower monthly bills for your business as well as adding value to the property.

Sources:

- https://www.donnellymech.com/blog/what-section-179-of-the-tax-cuts-and-jobs-act-means-for-commercial-hvac-equipment/

- https://www.achrnews.com/articles/137065-section-179-a-commercial-hvac-contractors-diamond-in-the-rough

- https://www.section179.org/section_179_deduction/https://www.donnellymech.com/blog/what-section-179-of-the-tax-cuts-and-jobs-act-means-for-commercial-hvac-equipment/

- http://www.airxchange.com/Collateral/Documents/English-US/Hidden%20Gem-%20Take%20Advantage%20of%20The%20Major%20Tax%20Break%20for%20Commercial%20HVAC%20Equipment6.pdf

- https://buildersheating.com/cut-your-2018-tax-bill-with-section-179/

- https://www.legacyheatingandairinc.com/blog/what-section-179-can-mean-for-your-business/

- https://fitsmallbusiness.com/section-179-deduction/

- https://www.thebalancesmb.com/what-is-a-section-179-deduction-397650